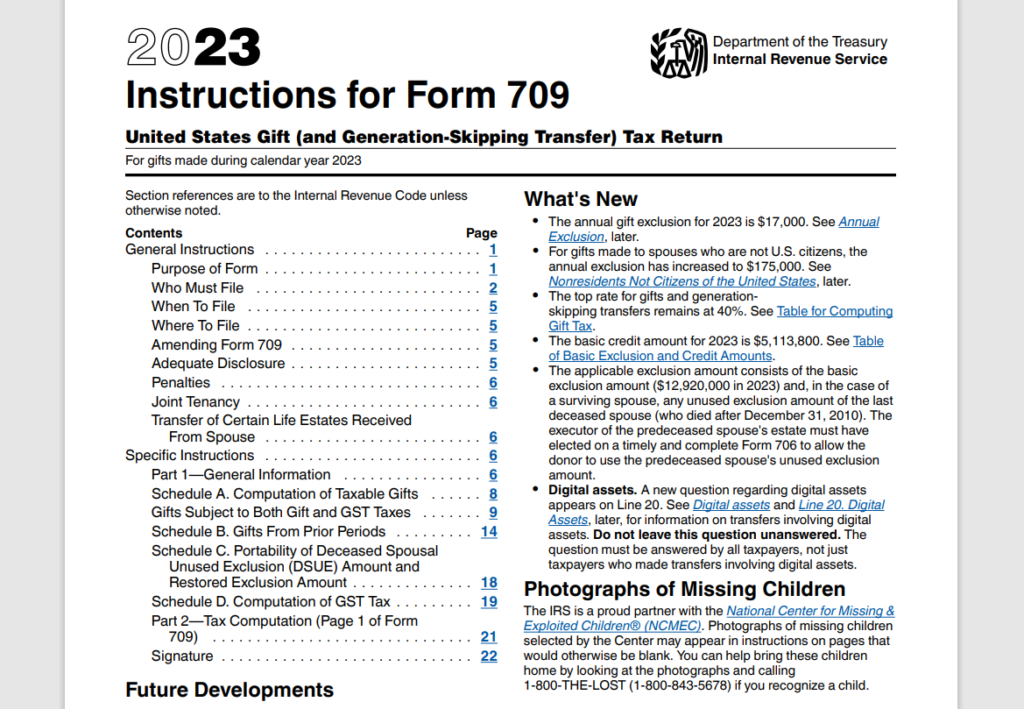

Form 709 Instructions

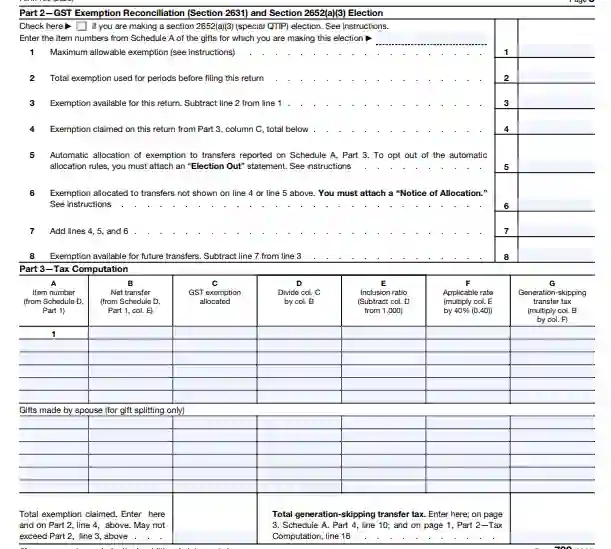

When it comes to reporting gifts on your taxes, understanding form 709 instructions is crucial. Form 709 also referred to as the United States Gift (and Generation Skipping Transfer) Tax Return is utilized for disclosing gifts given in the course of the year. The guidelines accompanying form 709 offer instructions, on filling out this form.

What is reported on Form 709?

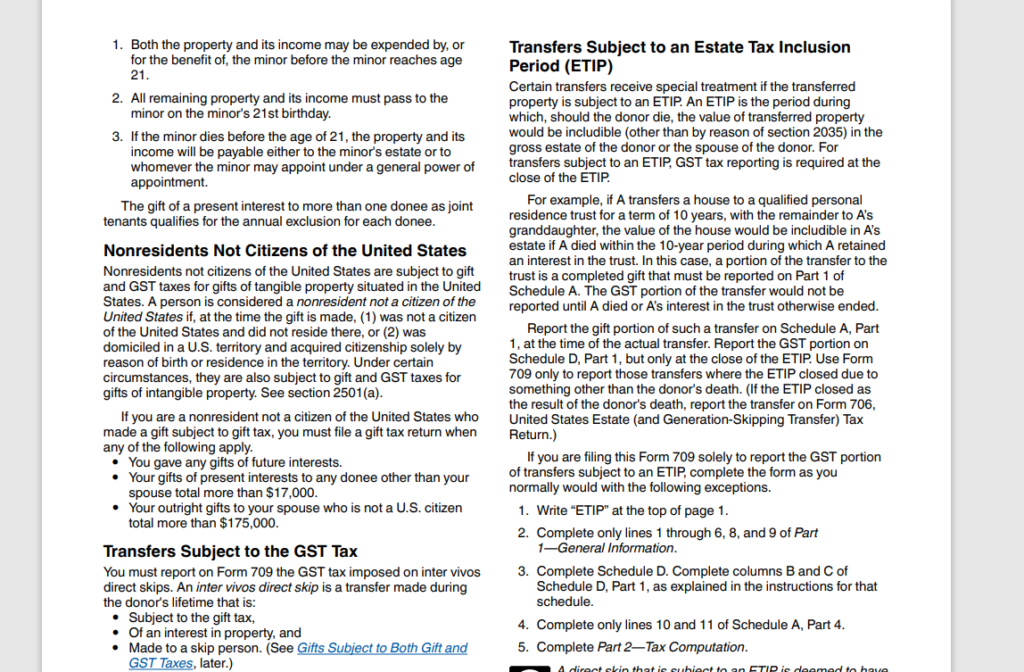

According to the instructions to form 709, you must use this form to report several types of gifts. The instructions for form 709 state that you must report gifts to anyone other than your spouse that exceed the annual exclusion amount, which is $17,000 for 2023. If you decide to give someone a gift valued at, over $17,000 in one year you’ll need to disclose it on Form 709.

The irs tax form 709 instructions also note that you must report certain gifts to your spouse if they have a future interest, meaning your spouse doesn’t have immediate access to the gift or its benefits. Moreover the guidelines outlined in IRS Form 709 state that any contributions, to a 529 plan surpassing the exemption should be disclosed. If you intend to share a gift with your partner to utilize both exemptions this must also be documented on Form 709. Finally, the 709 form instructions state that gifts of future interests of any amount must be reported.

It’s important to note that the irs form 709 instructions for 2022 and other years make it clear that certain types of gifts are generally not required to be reported on Form 709. Gifts, to groups eligible education or medical costs paid for someone and presents to your spouse who is a citizen are all considered exemptions. For information on these exceptions you can refer to the guidelines outlined in the IRS instructions, for Form 709.

What is the IRS Form For Reporting Foreign Gift?

When you need to declare gifts on your tax return it’s important to know the distinction, between reporting gifts from within the country and those from overseas. Although Form 709 is typically used for reporting gifts the IRS mandates a form, for disclosing foreign gifts, legacies or inheritances.

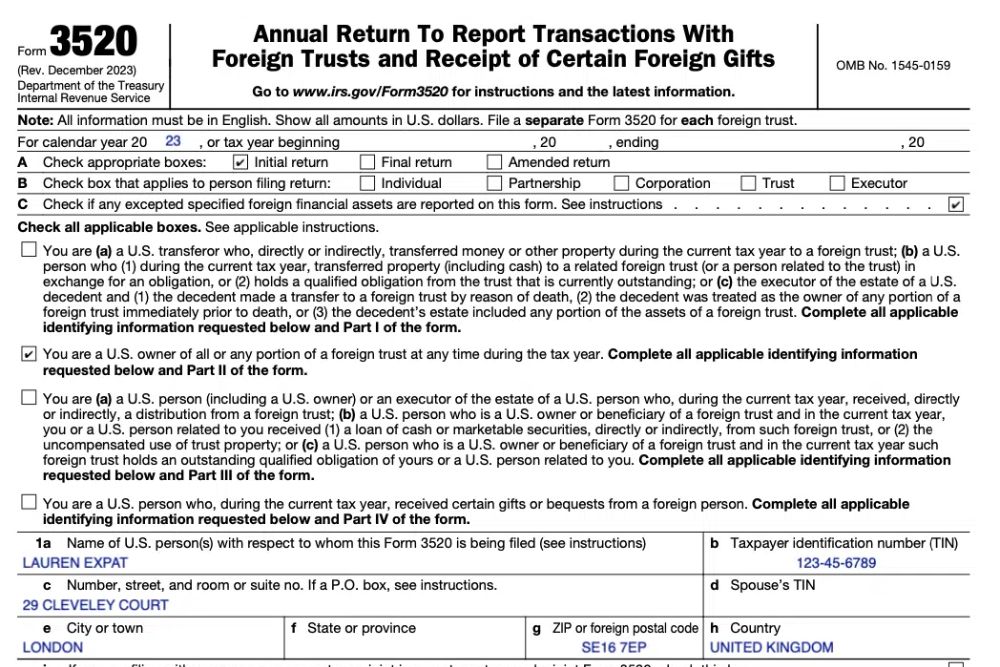

The 2022 form 709 instructions, as well as the instructions for other tax years, clearly state that foreign gifts should not be reported on Form 709. Taxpayers who get gifts or inheritances, from abroad need to fill out Form 3520 which is called “Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.”

The main aim of Form 3520 is to make sure that taxpayers are transparent, about any gifts or inheritances they receive from individuals, estates, trusts or companies. This form helps the IRS keep track of money coming into the United States from sources and prevents taxpayers from dodging their U.S. Tax responsibilities using gifts or inheritances.

The form 709 irs instructions provide clear guidance on when taxpayers must file Form 3520. If you happen to get a gift or inheritance from someone whether its an individual, estate or trust that goes beyond $100,000 in one tax year you must fill out Form 3520. This limit pertains to the value of all gifts or inheritances received from origins throughout the year not limited to a single gift or inheritance.

What is the difference between Form 3520 and Form 709?

The key difference between these two forms is the purpose they serve. As noted in the instructions for irs form 709, Form 709 is used to report gifts made by the taxpayer to others. Form 3520 on the hand is utilized to disclose gifts or inheritances received by the taxpayer from origins. The IRS guidelines, for Form 709, in 2022 and in years highlight this differentiation.

Another significant difference is the threshold for reporting. The form 709 instructions 2023 and prior years note that Form 709 has a much lower reporting threshold compared to Form 3520. In 2023 you need to report gifts on Form 709 if they exceed $17,000, per recipient. When it comes to Form 3520 you should report gifts from individuals or estates over $100,000 and gifts from corporations or partnerships over $17,131. It’s important to note that these reporting thresholds are different, from the exclusion amount specified in Form 709.

How to avoid form 709?

Many taxpayers wonder how they can avoid having to file Form 709. The 709 form instructions provide guidance on this matter. To avoid Form 709 it’s important to keep your gifts, below the exclusion limit of $17,000 per person for the year 2023. This means that you can give up to $17,000 to any one individual in a year without needing to fill out Form 709.

If you’re married the guidelines for Form 709 state that both you and your spouse can each gift up to $17,000 to the person without requiring Form 709. Essentially this allows a married couple to collectively gift, up to $34,000 to a recipient within a year without reporting the gift.

Another way to avoid filing Form 709 is to make gifts that are exempt from gift tax. The instructions for form 709 provide details on these exemptions. You could cover someones tuition or medical bills by sending the payment to the school or hospital which doesn’t require you to worry about gift tax or filling out Form 709. Moreover donations made to groups and specific charities are not subject, to gift tax.

How much money can I receive as a gift from overseas?

The irs form 709 instructions clarify that foreign gifts are not reported on Form 709. However that doesn’t mean foreign gifts are, off the reporting radar. If you happen to receive a gift from an individual or estate that goes beyond $100,000 within a year you’ll need to note it down on Form 3520. When it comes to gifts from corporations or partnerships the threshold for reporting stands at $17,131.

It’s important to note that these reporting thresholds for gifts are distinct from the $17,000 exclusion for domestic gifts as reported on Form 709. The guidelines, in the form 709 gift tax instructions emphasize that the annual exclusion doesn’t extend to gifts disclosed on Form 3520.

While you may not owe taxes on foreign gifts, the instructions for irs form 709 emphasize that you still must report them if they exceed the relevant thresholds. Failing to report foreign gifts when required can result in significant penalties.

How to report foreign inheritance?

Receiving an inheritance from a foreign source can raise questions about reporting requirements. The irs tax form 709 instructions clarify that inheritances, whether foreign or domestic, are not considered gifts for the purposes of Form 709. However, this doesn’t mean that foreign inheritances are exempt from reporting altogether.

If you receive a foreign inheritance that exceeds $100,000, you must report it on Form 3520. The instructions to form 709 make it clear that Form 3520, not Form 709, is used for reporting foreign inheritances. The instructions provided in Form 3520 will help you accurately report the inherited assets. It’s crucial to understand that the guidelines, for disclosing inheritances differ from estate tax regulations. Estate tax pertains to the individuals estate, whereas Form 3520 reporting obligations concern the recipient of the inheritance.

How do I get instructions for form 709?

When you’re preparing to submit Form 709 it’s important to have the instructions, for Form 709 on hand. The IRS revises these guidelines each year to incorporate any updates, in tax legislation or reporting standards. To get the most up-to-date instructions for form 709, you can visit the IRS website.

On the IRS website, you can search for “Form 709 instructions” or navigate directly to the instructions for form 709 page. Make sure to refer to the guidelines, for the tax year. For instance if you are disclosing gifts given in 2023 make sure to consult the 2023 form 709 instructions.

In addition to the form 709 instructions, the IRS website also offers other helpful resources related to gift taxes. IRS Publication 559 delves, into the intricacies of gift taxes. Offers assistance, beyond the information found in the form 709 gift tax instructions.

What does a form 709 instructions 2018?

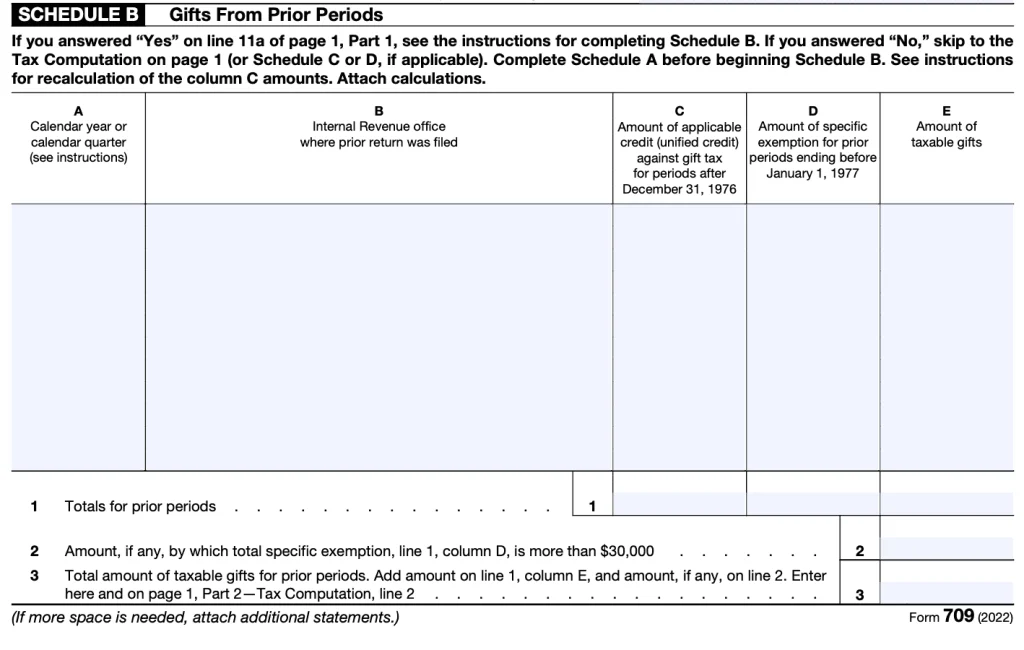

The form 709 instructions 2018 provide detailed guidance on how to complete Form 709 for gifts made during the 2018 tax year. These guidelines include details, like who needs to submit which presents require disclosure methods for determining gift worth and steps to apply deductions or exemptions.

It’s important to follow the guidelines for IRS form 709 corresponding to the year you are reporting on as there could be changes in thresholds, exemptions or other specifics annually. For instance the annual exemption limit was $15,000 per recipient in 2018. May vary in tax years.

The IRS offers a collection of years forms and instructions, on their website making it simple to access the guidelines you require. You can find the form 709 instructions 2018 in the forms and publications section of the IRS website, under the “Prior Year Products” heading.

When you look back at the instructions, from the year it’s important to stay updated on any changes in tax laws that might affect how you report your income. While the form 709 instructions from 2018 offer guidance on gifts given that year it’s an idea to check for any information or clarifications from the IRS to make sure you’re following the current tax rules.

Aside from following the instructions for the tax year taking a look at this years guidelines and relevant publications from the IRS can give you a better understanding of important concepts and reporting requirements.

By using the 2018 form 709 instructions, for reporting gifts given in that year and referring to instructions for years when necessary you can ensure accurate reporting and reduce the chances of making mistakes or facing penalties.

When will form 709 instructions be available 2018?

If you’re looking for a specific year’s irs instructions form 709, such as the form 709 instructions 2018, you can typically find them on the IRS website by mid-January of the following year. For instance the guidelines, for reporting gifts on IRS Form 709 for the year 2018 should have been accessible, by January of the year.

If you need access to a prior year’s 709 form instructions, you can check the IRS website’s forms and publications archive. The IRS keeps this collection to help taxpayers access past forms and guidelines. Besides visiting the IRS site you can subscribe to receive email alerts from the IRS. These notifications can inform you when new forms and guidelines such, as those for form 709 are published. This could be useful if you’re eagerly waiting for the instructions, for the year to be released.

Final Thought

Understanding the form 709 instructions is essential for properly reporting gifts on your tax return. The guidelines outlined in document 709 offer instructions on which presents must be disclosed how to accurately fill out the form and ways to steer clear of errors. By familiarizing yourself with the irs form 709 instructions, you’ll be better equipped to navigate the gift tax reporting process.

If you need help with the form 709 instructions, for 2023 guidelines on the form 709 gift tax instructions for a year or information about forms like Form 3520 you can find assistance, on the IRS website. Be sure to use the appropriate year’s instructions to form 709 and consult with a tax professional if you have complex gift tax situations.

By staying informed about the irs tax form 709 instructions and keeping accurate records of your gifts, you can ensure that you’re meeting your gift tax reporting obligations and avoiding potential penalties. With the right knowledge and resources, including the irs instructions for form 709, you can confidently navigate the gift tax landscape and make the most of your gifting strategies.