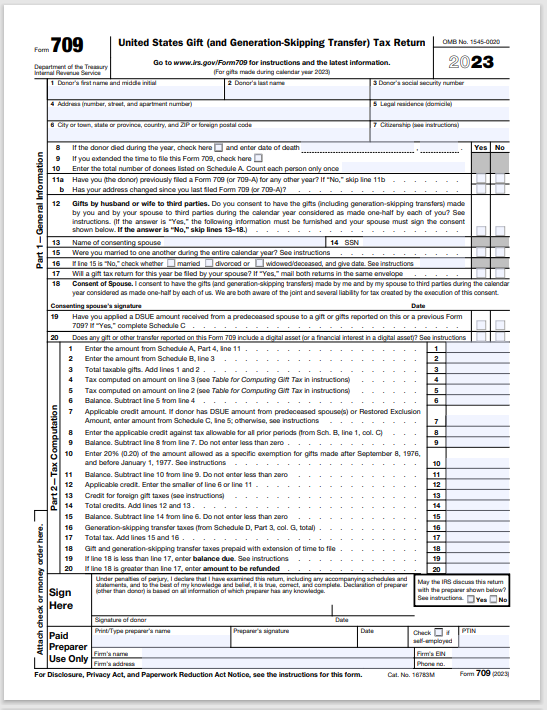

IRS 709 Tax Form

The IRS 709 tax form, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a crucial document for individuals who make significant gifts during a given tax year. If you’ve recently made a substantial gift, it’s essential to understand the ins and outs of the IRS tax form 709 instructions to ensure proper reporting and compliance with tax laws.

IRS 709 Instructions

To begin, let’s discuss the IRS 709 instructions. The step, by step guidance outlines how to fill out the IRS form 709, for gift tax return. It’s important to adhere to these instructions to prevent mistakes and potential fines. The IRS 709 guidelines address areas, including who needs to submit the filing deadline, which gifts should be reported and how to determine the tax amount owed.

One key aspect of the IRS 709 instructions is understanding the annual gift tax exclusion. By the year 2023 people can gift, up to $17,000 to each recipient without requiring the submission of IRS gift tax form 709. Yet if your gifts surpass this limit you must disclose them on the form.

Where to Mail IRS 709

Once you’ve completed the gift tax IRS form 709, you’ll need to know where to mail IRS 709. The address you should send your IRS form 709 gift tax return, to differs based on where you’re located. Typically you would mail the form to the IRS center that covers your region. The instructions, for IRS form 709 include a list of mailing addresses to your state of residence.

Make sure to verify the mailing address, on the IRS form 709 before you send it out. This will help prevent any delays or problems, with processing your return. If you’re unsure about where to mail IRS 709, consult the instructions or contact the IRS directly for guidance.

How to Fill Out IRS 709

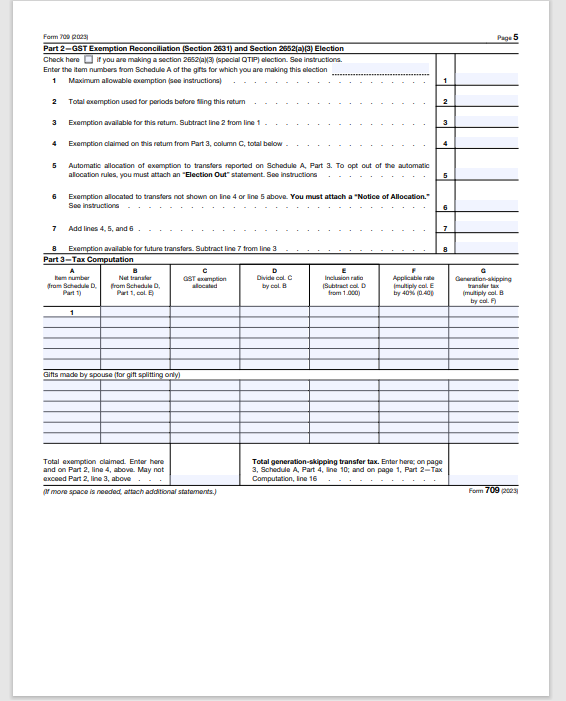

Knowing how to fill out IRS 709 is crucial for accurate reporting and compliance. The IRS form 709, for gift tax includes sections and schedules that ask for information regarding your gifts and the associated tax calculations.

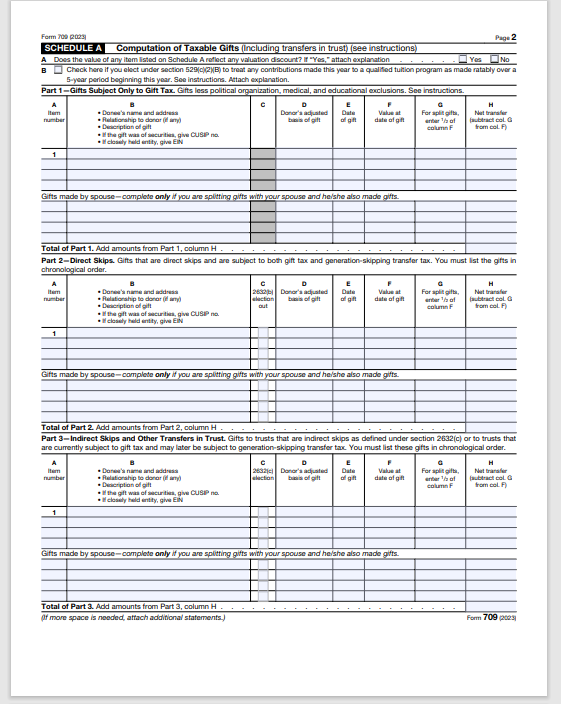

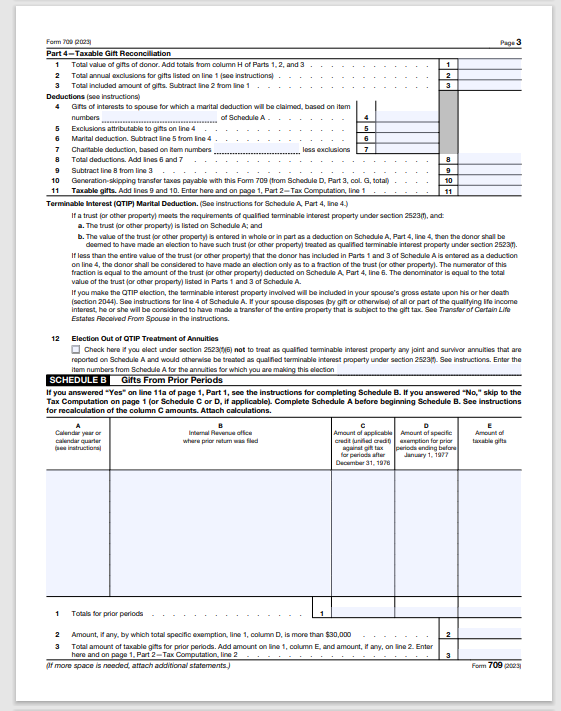

Please begin by entering your details, including your name, home address and Social Security number. Then, list the gifts you made during the tax year on Schedule A of the IRS gift tax form 709. Be sure to include a description of each gift, its value, and the recipient’s information.

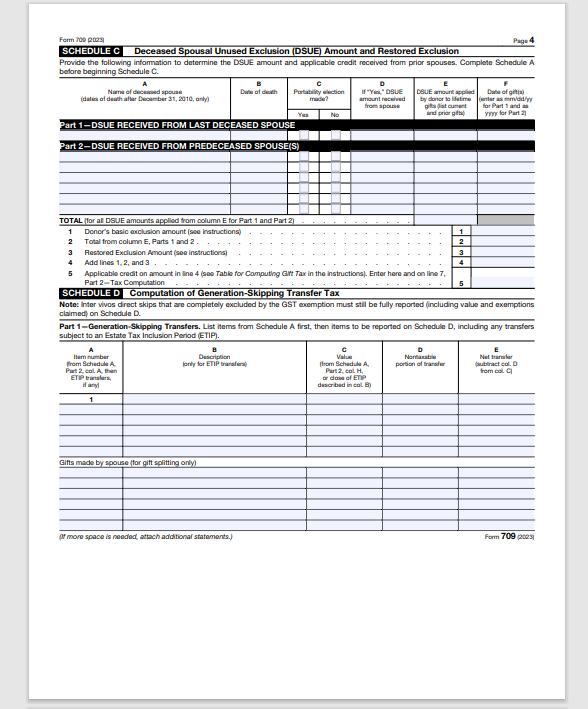

When giving gifts to a trust or another organization you will have to fill out forms, like Schedule B or Schedule C. These forms ask for details, about the trust or organization and the people it benefits.

IRS 709 Extension

If you need more time to file your IRS gift tax return form 709, you can request an extension. To request an extension, for IRS Form 709 you must submit Form 8892 which’s the Application for Automatic Extension of Time To File Form 709 and/or Payment of Gift/Generation Skipping Transfer Tax.

The IRS extension for Form 709 grants a six months to submit your gift tax return. It’s essential to remember that extending the filing deadline does not postpone the deadline for paying any gift tax owed. If there is a gift tax liability you must estimate the amount. Make a payment, by the deadline to avoid incurring interest and penalties.

IRS 709 Example

To better understand how to complete the gift tax IRS form 709, it can be helpful to review an IRS 709 example. The IRS provides a sample completed IRS form 709 gift tax return in the instructions, which illustrates how to report various types of gifts and calculate the tax liability.

Exploring a sample IRS 709 can assist you in getting acquainted with the structure of the form necessary details and typical situations. However, keep in mind that each individual’s situation is unique, and you should consult with a tax professional if you have specific questions or concerns about your gift tax returns IRS completed sample form 709 sample.

IRS 709 Instructions 2022

Make sure to refer to the edition of the IRS 709 guidelines when filling out your gift tax paperwork. The IRS 709 instructions 2022 provide the most up-to-date information on filing requirements, exclusions, and tax rates.

Be sure to download the IRS 709 instructions 2022 from the official IRS website or obtain a copy from a reliable tax preparation service. Using guidelines might lead to mistakes. Missing information, on your IRS Form 709, for gift taxes.

IRS 709 Mailing Address

Earlier I mentioned that the mailing address, for IRS Form 709 varies depending on where you live. You can find the IRS form 709 filing address in the instructions provided or on the IRS website.

Double-check the IRS form 709 address before mailing your return to ensure it reaches the correct processing center. Using the wrong IRS 709 mailing address could delay the processing of your return and potentially lead to penalties or interest charges.

IRS Form 709 Applicable Credit Amount

When completing the IRS form 709 gift tax return, you’ll need to understand the applicable credit amount. The credit amount that applies helps calculate the gift tax you might be responsible, for. The IRS form 709s credit amount is determined by the unified credit, which represents the combined gift and estate tax exemption, to a person throughout their life. In 2023 each individual has a credit of $12.92 million.

IRS Form 709 Address

In addition to the IRS form 709 mailing address, you’ll also need to provide your own address on the form. Be sure to use your current mailing address to ensure you receive any correspondence from the IRS regarding your gift tax IRS form 709.

Make sure to notify the IRS of your address by completing Form 8822 Change of Address before submitting your IRS gift tax form 709 if you’ve relocated recently. This step can avoid any delays or issues, with receiving mail regarding your gift tax return.

IRS Form 709 and Instructions

To ensure accurate completion of your gift tax returns IRS completed sample form 709 sample, it’s crucial to use the official IRS form 709 and instructions. The form and instructions are designed to assist you in completing the filing process and gain clarity, on your tax responsibilities.

You have the option to access the IRS form 709 and accompanying instructions online through the IRS website or request them via mail. It’s important to ensure that you utilize the version of both the form and instructions to prevent any mistakes or oversights.

IRS Form 709 Schedule A Continuation Sheet

If you need additional space to report gifts on Schedule A of your IRS gift tax form 709, you can use the Schedule A Continuation Sheet. This sheet allows you to list additional gifts that don’t fit on the main Schedule A page.

Be sure to attach any continuation sheets to your gift tax IRS form 709 when filing. Make sure to include all the pages to avoid any delays, in processing or any follow up requests, from the IRS.

IRS Form 706 and 709

Sometimes there are situations where you might have to submit both IRS Form 706 and 709. Form 706 is known as the United States Estate (and Generation Skipping Transfer) Tax Return. Its necessary, for estates that surpass the federal estate tax exemption threshold.

If you’re managing an estate that calls for Form 706 and the deceased individual gave gifts while you may also have to fill out IRS gift tax form 709 to declare those gifts. It’s advisable to seek advice, from a tax professional to understand your filing obligations in cases.

IRS Form 709 Gift Tax Exclusion

Finally, it’s essential to understand the IRS form 709 gift tax exclusion. In 2023 people can provide gifts of, up to $17,000, per person without having to fill out IRS tax form 709.. If your gifts go beyond this limit you must declare them on the gift tax IRS form 709. Remember that the annual exclusion pertains to each recipient allowing you to give up to $17,000 to people without needing to submit the form.

Final Thought

The IRS 709 tax form is a critical document for individuals who make significant gifts during a given tax year. By familiarizing yourself with the guidelines, for completing IRS Form 709 knowing the mailing address, for sending the form to the IRS understanding the process of filling out Form 709 and being aware of important details you can effectively adhere to tax regulations and fulfill reporting requirements.

Always use the most current IRS 709 instructions and consult with a tax professional if you have any questions or concerns about your specific situation. Having the understanding and readiness you can effectively handle the IRS form 709, for gift tax. Meet your tax responsibilities with confidence.